If you’re a parent who wants to give your child a head start with money, setting up a custodial investment account could be one of the smartest decisions you make.

These accounts allow you to invest on behalf of your child—whether it’s for their education, first car, or future financial independence. But depending on where you live, the type of account you can open (and how easy it is to do so) can vary a lot.

In this post, we’ve broken down the most common custodial account options in the United States, Canada, Germany, the UK, and Spain—with extra tips for cross-border families, international living, and how to prepare for the process.

- What Is a Custodial Investment Account?

- Why It Matters Where You Live

- Custodial Investment Accounts Comparison Table

- 🇺🇸 United States – UGMA/UTMA Custodial Accounts

- 🇨🇦 Canada – Informal Trust Accounts (ITF)

- 🇩🇪 Germany – Junior Depots (Kinderdepot)

- 🇬🇧 United Kingdom – Junior ISA (JISA)

- 🇪🇸 Spain – Robo-Advisors & Cross-Border Options

- 🌍 Cross-Border Families: What You Need to Know

- Legal & Tax Considerations

- 🚀 Getting Started: What You Can Do Next

What Is a Custodial Investment Account?

A custodial investment account is a financial account that an adult (usually a parent or guardian) manages on behalf of a minor. The adult makes decisions and manages the account until the child reaches the legal age of control, which ranges from 18 to 21, depending on the country and account type.

With these accounts, you can invest in:

- 🧾 ETFs and mutual funds

- 💼 Stocks and bonds

- 🤖 Robo-advisors with kid-friendly portfolios

- 💸 Or even just set up high-interest savings for children

These tools not only help grow your child’s future wealth—they also open the door to early financial education, family money conversations, and a real-world understanding of investing.

Why It Matters Where You Live

Depending on your country (or even your residency status), you’ll have different account types available—and different rules to follow.

For example:

- In the US, custodial accounts are common and well supported.

- In Canada, you’ll open an informal trust, but taxes may apply differently.

- In Germany, you can open a “Junior Depot,” and some brokers allow access from other EU countries.

- In the UK, a Junior ISA offers tax-free growth, but the money is locked in.

- In Spain, the options are limited—but there are creative cross-border workarounds.

Let’s break it all down country by country:

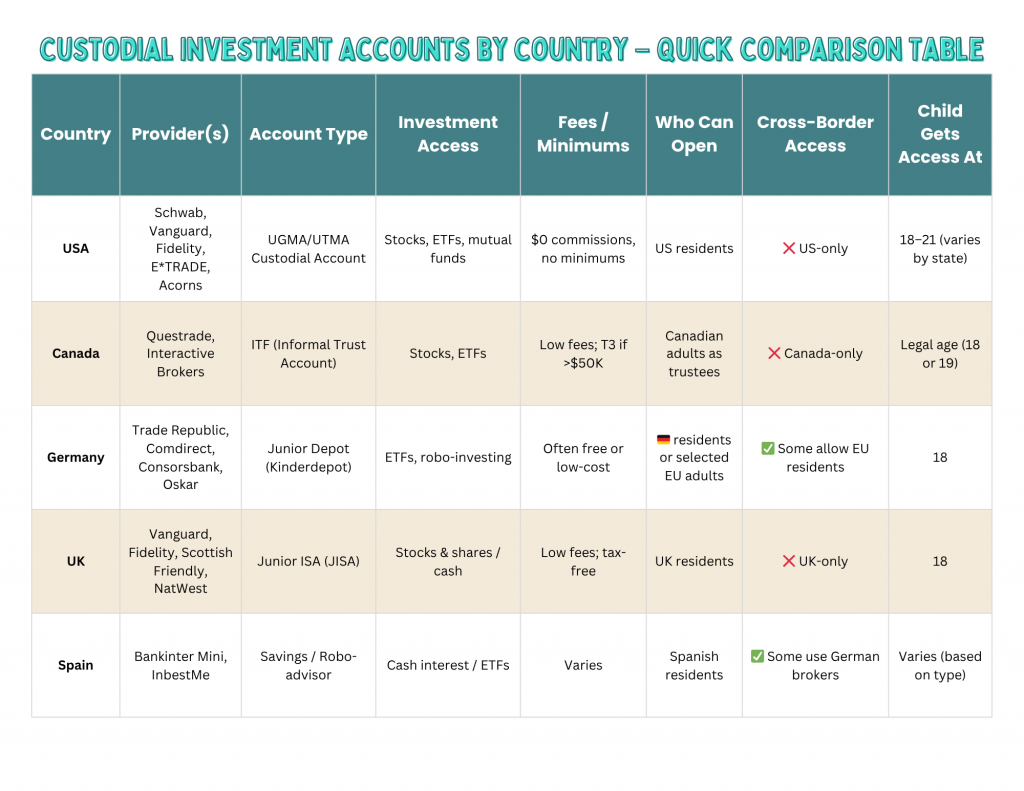

Custodial Investment Accounts Comparison Table

🇺🇸 United States – UGMA/UTMA Custodial Accounts

The US has a well-developed custodial account structure through UGMA (Uniform Gifts to Minors Act) and UTMA (Uniform Transfers to Minors Act). These accounts allow you to invest in your child’s name while retaining control.

Top Providers:

- Charles Schwab

- Fidelity

- Vanguard

- E*TRADE

- Acorns Early

What Makes It Great:

✅ No account minimums

✅ Commission-free trading (ETFs, stocks, mutual funds)

✅ Easy to open online

✅ Funds can be used for any purpose when the child comes of age (not just education)

Things to Consider:

- The child gains full control at age 18 or 21 (depending on the state).

- Kiddie tax rules apply: a portion of unearned income over ~$2,700/year (2025) may be taxed at the parent’s rate.

Check out this comparison site of the best custodial accounts.

🇨🇦 Canada – Informal Trust Accounts (ITF)

Canada doesn’t have a formal “custodial” system like the US—but you can still invest for your child by opening an In Trust For (ITF) account at brokerages like Questrade or Interactive Brokers.

What You Can Do:

- Invest in ETFs, stocks, and mutual funds

- Act as trustee for the child until they reach the age of majority (18 or 19 depending on province)

What to Watch Out For:

⚠️ Income attribution rules: investment income may be taxed to the parent until the child is of age

⚠️ As of 2023, balances over CAD 50,000 may trigger T3 trust filing requirements

Ideal For:

Parents who want more flexibility than an RESP (which is education-specific) and who are comfortable managing taxes.

🇩🇪 Germany – Junior Depots (Kinderdepot)

Germany offers several Junior Depots—custodial investment accounts specifically for minors, opened and managed by parents. The great news? Some of these brokers allow non-German EU residents to apply as well.

Popular Options:

- Trade Republic Kinderdepot (Germany only)

- Comdirect Junior Depot

- Consorsbank Junior Depot

- Oskar (Robo-advisor)

- Finanzen.net Zero Kinderdepot (Zero-fee ETF platform)

What Makes Germany Stand Out:

✅ Wide access to low-fee ETFs

✅ Some brokers allow Spanish, Belgian, Dutch, Austrian, Swiss residents

✅ New features like fee-free ETF investing for kids at Trade Republic

✅ User-friendly apps and automation

What to Check:

- Whether your country is supported (Comdirect and Consorsbank are good bets for EU expats)

- Documentation needs (some require proof of tax residence, national ID, etc.)

Our Experience:

We personally opened a custodial account with Consorsbank while living in Spain—so it’s doable, even if your country doesn’t offer great native options.

Check out this page for a comparison of the best junior depots.

🇬🇧 United Kingdom – Junior ISA (JISA)

The Junior Individual Savings Account (JISA) is the UK’s go-to option for investing for children. These accounts are tax-free and must be opened by a parent or guardian, but are in the child’s name.

Who Offers JISAs:

- Vanguard UK

- Fidelity UK

- Scottish Friendly

- NatWest

- Hargreaves Lansdown and others

Why Parents Love JISAs:

✅ Up to £9,000/year tax-free (2025–26)

✅ Choose between cash and stocks & shares

✅ Funds grow tax-free and are locked until age 18

What to Consider:

- Only available to UK-resident children

- The funds legally belong to the child at 18

- No early withdrawals, even for emergencies

🇪🇸 Spain – Robo-Advisors & Cross-Border Options

Spain has fewer traditional investment accounts for children, but you can still find workable options—especially if you’re open to cross-border solutions.

Local Options:

- Bankinter Mini Account – 5% interest on savings

- InbestMe Kids – Goal-based robo-advisor portfolios for kids

Better Option (If You’re Willing to Go Cross-Border):

German brokers like Consorsbank often accept Spanish residents. With the right paperwork, you can invest in ETFs and index funds just like in Germany.

📌 Tip: Start with your own adult account and ask if you can open a junior depot as an existing customer.

🌍 Cross-Border Families: What You Need to Know

If you’re living in a country that doesn’t offer strong custodial account options, you might still be able to open one through another EU country. German brokers like Consorsbank and Comdirect have become popular with families across Europe—including those living in Spain, Austria, the Netherlands, and Belgium.

What You’ll Likely Need:

- Parent/guardian’s government-issued ID

- Child’s birth certificate or ID

- Proof of residency (e.g., utility bill)

- Tax ID (for both parent and child, if applicable)

- A bank account with IBAN in your name

Always double-check current terms and reach out to the broker’s support team—they’re often helpful, especially with EU-based documents.

Legal & Tax Considerations

Before opening an account, it’s important to understand the legal side:

- Who owns the money? In most countries, the money legally belongs to the child

- Tax impact: Depending on the account, income may be taxed to the parent or child

- Control: What happens when your child turns 18? Can they access the funds freely?

We recommend speaking to a tax advisor if you’re unsure about the rules in your country—especially for ITF accounts in Canada or cross-border setups in the EU.

🚀 Getting Started: What You Can Do Next

✅ Download our free checklist & comparison chart to help you prepare

✅ Choose the provider that fits your residency, goals, and comfort level

✅ Include your child in the process—make it a learning experience!

✅ Start small—many accounts allow investing from just $1 or €1/month

📥 Grab the Printable

We’ve created a free printable bundle to go with this post, including:

- ✅ A step-by-step checklist to get ready

- ✅ A country-by-country comparison chart

- ✅ Tips on documents, residency, and choosing the right account

Download here:

👉 Follow us on Instagram @liams.money.club or visit our Money Club section for more!

💬 Over to You!

Are you already investing for your child? Do you live in a country where it’s tricky to open a custodial account? We’d love to hear about your experience.

Drop a comment below or send us a message—we’re building a community of families committed to raising money-smart kids, one step at a time 💚

Disclaimer: The information in this post is based on publicly available sources at the time of writing. Account availability, fees, and eligibility requirements may change. Please check directly with each provider for the most up-to-date details.

Money Smart Kids

💡 Teach kids about money the fun way!

This printable 70+ page workbook is packed with hands-on activities that help children ages 5–9 explore earning, saving, spending, giving, and even the basics of investing.

Perfect for home or classroom use!

🎓 Builds real-life money skills

👨👩👧👦 Great for family learning

🖨️ Includes US Letter & A4 sizes – ready to print and go!

Check out the free sample and our free Income Tracker!