Teaching kids about money doesn’t have to be complicated—it can be fun, hands-on, and part of everyday life. With a few simple tools and routines, parents can lay the foundation for healthy financial habits that last a lifetime.

💡 Why It Matters-and Why Now

Studies show that money habits are often set by age 7. Early conversations about spending, saving, and earning help children develop skills in delayed gratification, budgeting, and goal-setting—skills linked to future success.

At home, we’ve embraced this with Liam. He chooses chores he wants to do—like tidying toys or helping in the kitchen—and earns a little money each week. We track his earnings with our printable Income Tracker, and he’s saving up for a toy he’s chosen—proudly paying for it with his own money!

That sense of ownership is powerful and teaches kids that money comes from effort, not magic.

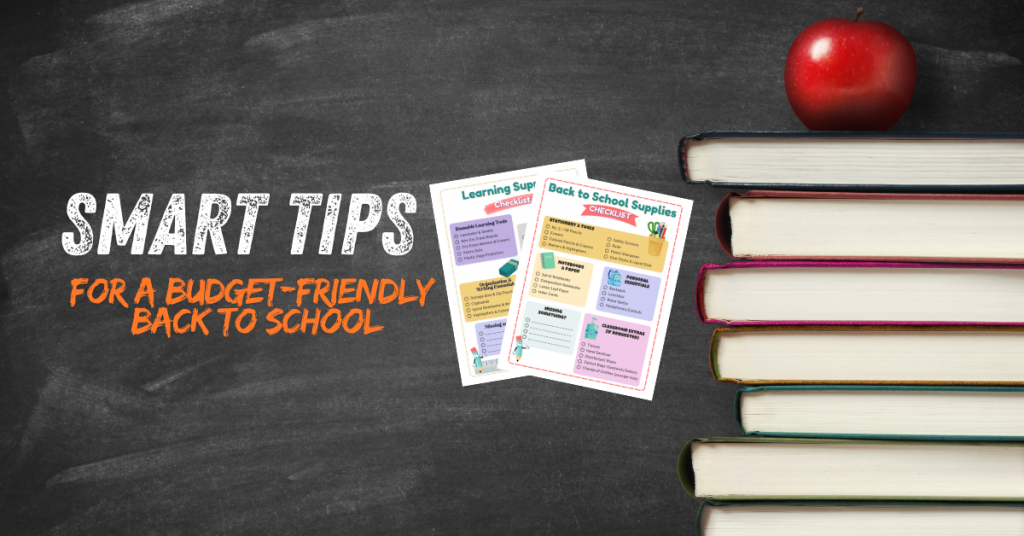

🧠 Age-by-Age: Teaching Money the Smart Way

Every age is a new opportunity to build money confidence. That’s why we created our “From Piggy Banks to Portfolios” chart—to give you a clear, visual roadmap of what financial skills kids can start learning as they grow.

Let’s walk through it together:

Teens: Older kids can explore topics like investing, credit, online banking, and earning real income from part-time work or a small business idea. This is where the foundation you’ve laid starts to pay off—literally.up with a lifetime of confidence and financial savvy.

Ages 3–5: This is the perfect time to introduce the basics. Kids can learn to recognize coins and bills, understand that money is used to buy things, and even start sorting their change into jars. Using a piggy bank or clear jars labeled “Save,” “Spend,” and “Share” is a fun, hands-on way to kick off the journey.

Ages 6–8: Kids are ready to explore earning and budgeting! Many families (like ours) start giving pocket money in exchange for simple chores. Our son Liam chooses his own chores from a chart and tracks his earnings with our printable income tracker—he’s currently saving up for a toy he picked out himself!

Ages 9–12: This is a great time to dive into more advanced concepts like needs vs. wants, setting savings goals, and understanding value over impulse. You can even introduce basic banking ideas like opening a youth savings account or reviewing a (mock) monthly budget together.

🪙 Simple Money Lessons You Can Start Today

Want to start teaching financial literacy right now? Here are some easy, everyday ideas:

- Earn It: Give your child the chance to earn money through small chores. Let them choose which ones they want to do—it makes the reward more meaningful!

- Track It: Use a simple tracker (like our free printable income tracker!) to help them see how their savings grow.

- Save It: Create a “Save, Spend, Share” jar system to introduce budgeting and giving.

- Talk About It: Include your kids in small money conversations—like why you compare prices or wait for sales.

- Celebrate Goals: When they hit a savings target, let them make the purchase themselves—it’s a powerful learning moment.

🛠 More Everyday Money Activities

To make money lessons stick, try fun activities like:

- Money jar systems (Save, Spend, Give)

- Mini lemonade stands to teach planning and profit

- Grocery budgeting games—let kids help pick items while sticking to a budget

- Allowance systems—linked to effort and responsibility

- Model smart money choices—narrate your own decisions as teaching moments

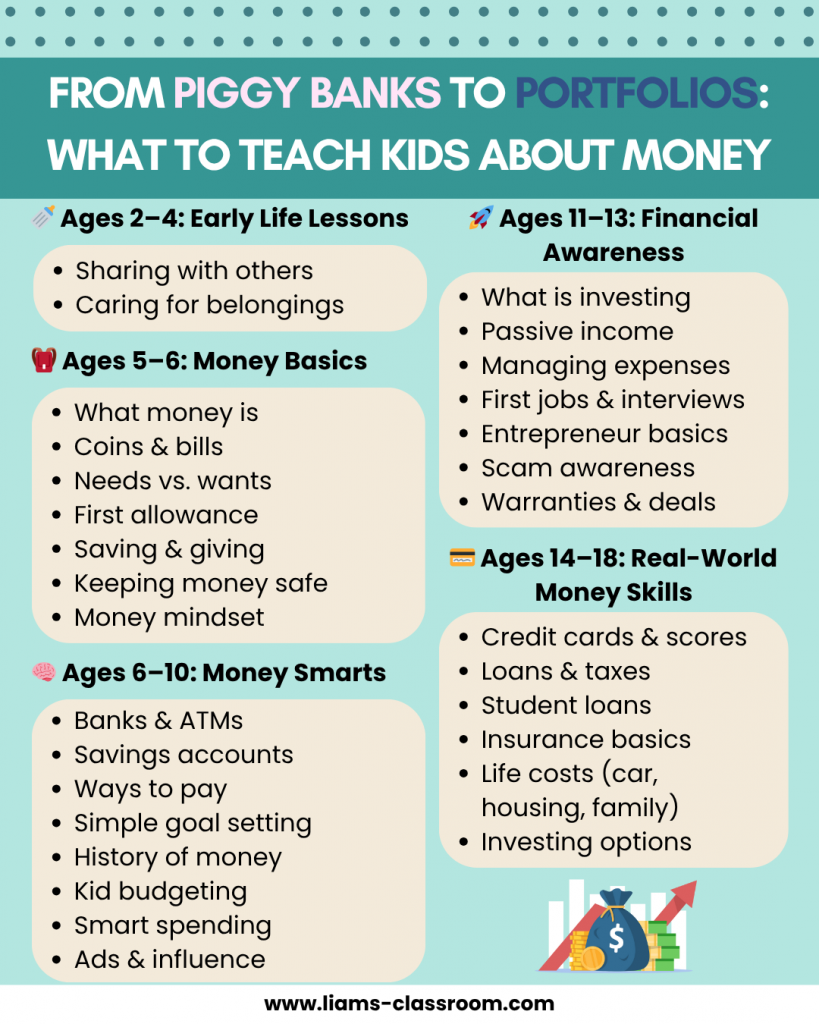

📘 Introducing: Money Smart Kids Workbook

To help families dive into these lessons, we created the Money Smart Kids Workbook. It’s packed full of beginner-friendly activities, including:

- Earning and tracking (just like we do with Liam)

- Goal‑setting, saving, and spending visuals

- Fun exercises on needs vs. wants

- Pages to build mini budgets and practice decision-making

✅ Tips to Make Money Learning Stick

- Start early and keep lessons small and consistent.

- Make it tangible—real coins, jars, and goals help children understand.

- Celebrate small wins, like reaching a savings target or budgeting wisely.

- Keep the conversation open and relaxed, not formulaic or stressful.

Ready to inspire financial confidence in your child?

📥 Download the Money Smart Kids Workbook here!

📤 Get the printable Income Tracker to start earning today!